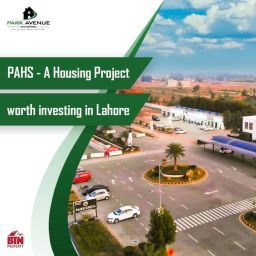

To evaluate the financial health of a company, several financial metrics are considered. To accurately examine a company’s health; areas like liquidity, profitability, solvency, and operating efficiency should be studied. These areas help to identify the financial strengths and weaknesses of a company or organization. This report aims to analyze the overall financial profitability, liquidity, and to better understand the performance & position of PAHS.

Mr. Naushad Ghani, the Chief Financial Officer of PAHS, is responsible for financial reporting like preparing balance sheets, tracking cash flow, calculating income statements, etc. He plays a vital role in the short-term and long term planning of PAHS; as budget is an essential ingredient for any arrangements, policies, and developments.

He told us that the process to recover monthly installments is flowing smoothly. Alhamdulillah! The response of the plot assignees is extremely positive as many of them have made prompt payments. Around 70-80% of plot allottees are paying their monthly installments timely, and most of the remaining are out of the station and unable to deposit their payments. Generally, plot allottees pay their monthly installment online.

PAHS is 100% complying with the tax obligations and paying tax to the Punjab Revenue Department, he added. The ability to generate profits and sufficient cash flow to pay bills and repay debts is known as the financial strength of a company. We have not taken out any loan from any bank and there are no financial shortfalls. So, PAHS currently has a very healthy financial situation.